Future cash flow calculator

This NPV calculator will help you to determine what net impact a prospective investment will have on future cash flows when accounting for the time value of money -- without having to deal. The best tool to calculate future cash flows of a company is to use Excel or a similar spreadsheet.

The total value or equity value is then the sum of the present value of the future.

. Projecting your cash flow is essential for your business financial plan but it can be overwhelming. Discounted cash flow calculation for every stock. In order to calculate NPV we must discount each future cash flow in order to get the.

By default it uses Earnings per Share to run valuations. This financial calculator can help you calculate the future value of an investment or deposit given an initial investment amount the nominal annual interest rate and the compounding period. Plus avoid the headache of.

Baca Juga

If your money is too tied. It calculates the discount rate by using future cash flows present value and the number of years input data. Ad QuickBooks Financial Software.

By inputting amounts in the spreadsheet you can see. A cash-flow calculator gives you visibility of your future cash needs and an opportunity to influence your businesses cash flow. Rated the 1 Accounting Solution.

Alternatively if you would like to save time. Home financial present value calculator Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or. The discounted cash flow stock valuation calculator is relatively straightforward but allows customization with advanced options.

Those future cash flows must be discounted because the money earned in the future is worth less today. Cash you have now. Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market so if you want to.

The discount rate calculator is a free online tool. Retirement Savings and Cash flow during Retirement. The income approach the cost approach or the market comparable sales approach.

The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic. Business valuation BV is typically based on one of three methods. Rated the 1 Accounting Solution.

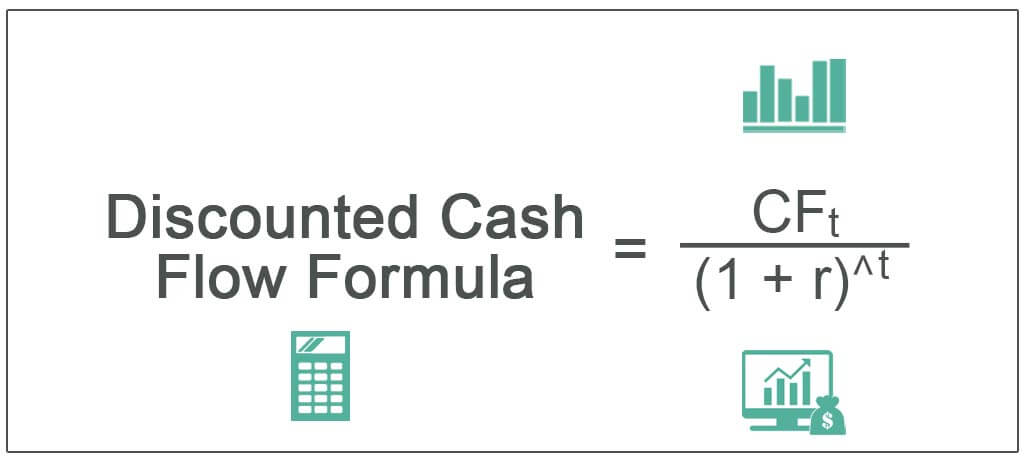

Determine Your Future Cash Flow. This calculator calculates the amount of money you can withdraw in retirement. Discounted Cash Flow Calculator.

Discount Rate Formula DR. Ad QuickBooks Financial Software. 15 hours agoPresent Value of Terminal Value PVTV TV 1 r 10 US16b 1 61 10 US898m.

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Payback And Present Value Techniques Accountingcoach

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Free Cash Flow Calculator Double Entry Bookkeeping

Future Value Of Cash Flows Calculator

How To Use Discounted Cash Flow Time Value Of Money Concepts

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Present Value Formula Calculator Examples With Excel Template

Free Cash Flow Formula Calculator Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Present Value Of A Single Cash Flow Finance Train

2022 Cfa Level I Exam Cfa Study Preparation